Professional

Services

Firms

Professional

Services

Firms

In addition to our Core Services, we work closely with professional services firms to design and maintain structures that stand up to ATO scrutiny while supporting long-term wealth creation. This includes navigating Personal Services Income (PSI) rules, professional firm profit allocation guidelines, and broader risk management frameworks.

If you’re running a consulting, HR, marketing, legal, engineering, mortgage broking, or similar professional services firm – whether solo or with a growing team – read on to hear how we can help structure your business effectively.

Who We Help.

Legal professionals, consultants, engineers.

Marketing & HR firms, architects, creatives

Mortgage brokers, town planners, IT, allied heath

Professional services firms face a different set of challenges as they grow. As income increases and structures evolve, the complexity often sits behind the scenes: how income is derived, how profits are distributed, and how the business is structured from a tax and compliance perspective. Getting this right creates clarity and provides a platform not just for the business itself, but for wider wealth creation over time.

One common (and often misunderstood) challenge is successfully navigating the ‘PSI rules’.

Personal services income (PSI) explained.

Most professionals have heard their accountant mention concepts like “personal services income”, “PSB status”, or whether income can be split, retained, or distributed more flexibly. The difficulty is that these rules are frequently misapplied – sometimes in completely opposite ways. Some advisers are still influenced by how professional firms operated years ago, before the current PSI and professional firm profit allocation frameworks were properly embedded. Others take an overly cautious view, assuming the rules apply more broadly than they do in practice, which can result in unnecessary tax, rigid structures, and lost planning opportunities.

Income Splitting & Profit Retention

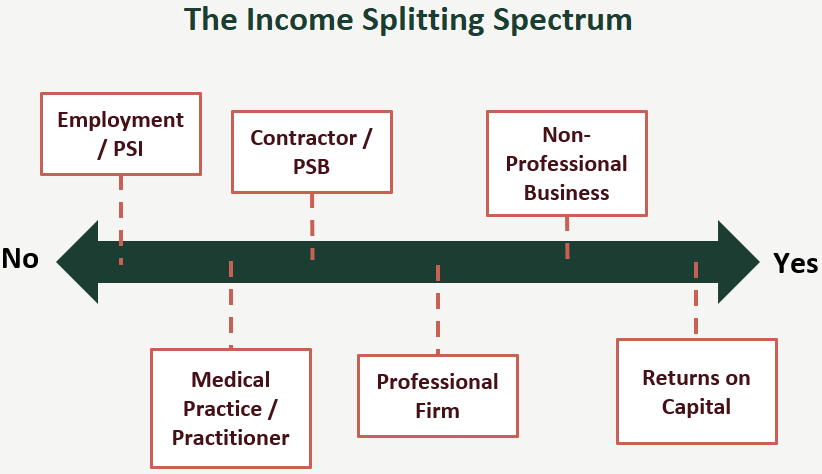

At its core, income splitting (and profit retention) is about who is taxed on income, when, and at what tax rate. The further you move away from pure employment-style income, the more flexibility the tax system allows, but only where that flexibility is commercially justified.

Think of it as a spectrum. At one end is employment-like income, where the ATO expects income to be taxed almost entirely in the hands of the individual doing the work. There’s little to no scope to divert, retain, or split that income without triggering risk. At the other end are businesses generating returns from systems, staff, capital, or assets, where profits can be retained, distributed across family members and other entities, or reinvested over time.

Why does this matter? Because splitting or retaining profits can:

Smooth cash flow and tax outcomes year to year

Allow surplus profits to be reinvested into growth or investments without losing half to income tax

Support asset protection and long-term wealth strategies

Most professional firms sit somewhere in the middle. They aren’t pure employment, but they also aren’t capital-heavy businesses. The challenge (and opportunity) is understanding where your income genuinely sits on this spectrum, and structuring accordingly. That’s where PSI, PSB status, and the professional firm profit rules come into play.

This becomes increasingly important once business profits push beyond the $190k range, where the top personal tax rate of 47% applies.

What is Personal Services Income (PSI)?

Personal Services Income (PSI) is income that is mainly a reward for an individual’s personal skills, knowledge, effort or expertise. Critically, PSI is determined by the nature of the income, not the structure used to earn it. You can earn PSI through a sole trader, company, or trust (often referred to as a Personal Services Entity, or PSE). Where PSI applies, the tax law limits how that income can be split, retained, or diverted away from the individual who performed the work.

By contrast, where income is generated by a genuine business structure – involving staff, systems, significant assets, multiple income sources, or capital - profits are treated as business income and can generally be retained or distributed more flexibly.

Determining which type of income you’re generating is just the starting point. From there, the analysis shifts to how the ATO expects that income to be taxed, allocated, and supported in practice.

What type of income are you generating?

When generating PSI.

Where income is classified as PSI, the next step is assessing whether the business qualifies as a Personal Services Business (PSB). The PSB tests look at how the work is generated and delivered: factors like having multiple clients, advertising to the market, employing others to do the work, or maintaining business premises.

If PSB status is satisfied, the income is treated more like ordinary business income, and the PSI restrictions largely fall away. If not, the PSI rules apply and significantly limit income splitting and profit retention. Even when the tests are passed, structuring decisions still need to be made carefully, as the ATO will look beyond labels and assess whether arrangements are commercially justifiable or simply designed to divert income, particularly under general anti-avoidance principles.

When generating income from a business structure.

Where income is not PSI – because it is generated through a genuine business structure with staff, systems, assets, and commercial risk – the analysis shifts. Instead of PSI, the focus moves to how profits are allocated and whether that allocation aligns with the ATO’s professional firm guidance.

This framework looks at how much profit is appropriately attributed to the principal’s personal efforts versus the broader business, and whether distributions to other entities or family members are commercially defensible. When structured correctly, this allows for far greater flexibility in retaining profits, funding growth, and building wealth outside the business, while still operating within acceptable ATO risk parameters.

How we can help your firm.

In reality, this is rarely a simple yes-or-no exercise. Our role is to step back and look at how your income is generated and where you sit on the ATO’s risk spectrum. For some clients, that means working through the PSI and PSB tests properly and ensuring any structure used is technically sound and defensible. For others, it means designing profit allocation and structuring arrangements that reflect commercial reality and support longer-term wealth creation.

This is an area where experience matters. Accountants who don’t truly understand these rules often fall into one of two camps: they’re overly cautious and leave clients paying more tax than necessary, or they take positions that aren’t well supported and expose clients to substantial risk.

Our focus is to get the best possible tax outcome within an acceptable risk framework, so profits can be retained, reinvested, and compounded over time, all without unpleasant surprises down the track.

Structuring for success.

Once we’ve properly understood how your income is generated and where you sit within the ATO’s risk framework, the next step is structure. This is where compliance stops being a constraint and starts becoming an opportunity.

For professional services firms, good structuring isn’t about chasing clever tax tricks. It’s about isolating risk, creating flexibility around profits, and giving you options as the business grows. Done well, the right structure lets you run the business confidently while using surplus profits to build wealth outside of it.

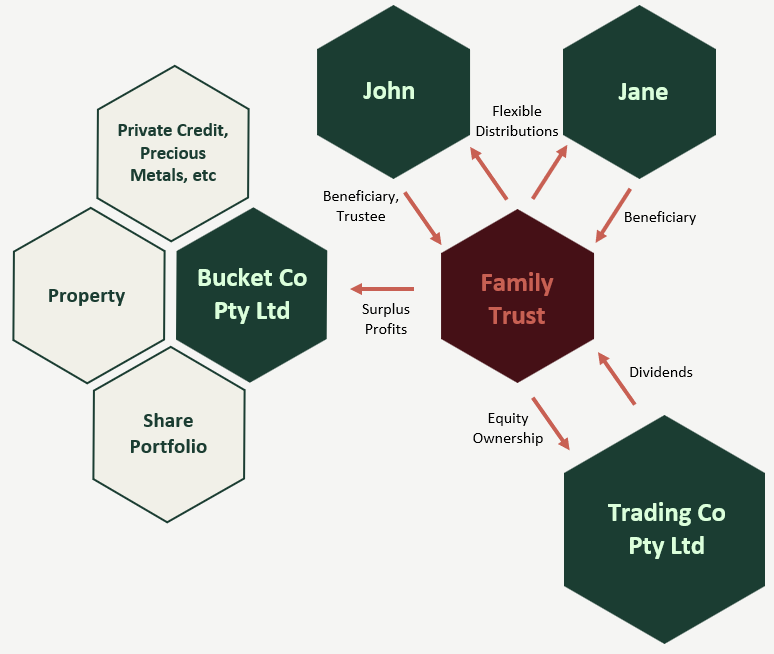

The diagram shows one example of how this can work. In this scenario, the trading company runs the business, with ownership held through a discretionary family trust. Profits can be distributed to individuals where appropriate, or streamed into a separate bucket company, where excess profits can be retained and invested into assets like property, shares, private credit or other investments – well away from the operating risk of the firm.

There is no off-the-shelf solution. The right structure depends on how your firm operates, the applicable tax rules, your risk profile, and what you’re trying to achieve over the next 5–10 years. Our job is to design structures that make commercial sense, hold up technically, and support real wealth creation over time.

If you’re starting a new professional services firm, looking to buy into an existing business, or simply unsure whether your current structure is still working for you, get in touch to talk through your options.